do you pay property taxes on a leased car in missouri

The highest amount that can be charged for tax is. Even if the vehicle is not.

13560 13574 Northwest Industrial Dr Bridgeton Mo 63044 Industrial For Sale Loopnet

For vehicles that are being rented or leased see see taxation of leases and rentals.

. Sales tax is often confused with personal property tax. Missouri collects a 4225 state sales tax rate on the purchase of all vehicles. As a result the lease agreement would most likely require the tax to be paid by the taxpayer.

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. If you purchased a new vehicle from a new-car dealer you will have an MSO instead of a title. And you do not have personal property taxes due to any Missouri county.

This page describes the taxability of. The terms of the lease will decide the responsible party for personal property taxes. If you did not.

Sales tax is paid at the License Bureau on a new purchase. The most common method is to tax monthly lease. Who pays the personal property tax.

In all cases the tax assessor will bill the dealership for the taxes and the dealership will. The leasing company is generally billed for personal. For example in Alexandria Virginia a car tax is 5 per 100 of the estimated value while in.

Paying property taxes on your car in Missouri is simple and can be done entirely online. Ive never leased a car and. Can someone who has leased a car in Missouri explain how the leasing company handles our wonderful personal property tax.

So if you live in a state with a. If you were leasing the vehicle on January 1 of the previous tax year your leasing company may. If the leaserental company elects to pay taxes at the time of titling a.

There is also a local tax. While Missouris sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. I no longer live in Missouri do I still owe this tax bill.

Taxes are based on. The purchase of a vehicle is also subject to any local taxes mentioned above. The tax is levied as a flat-rate percentage of the value and varies by county.

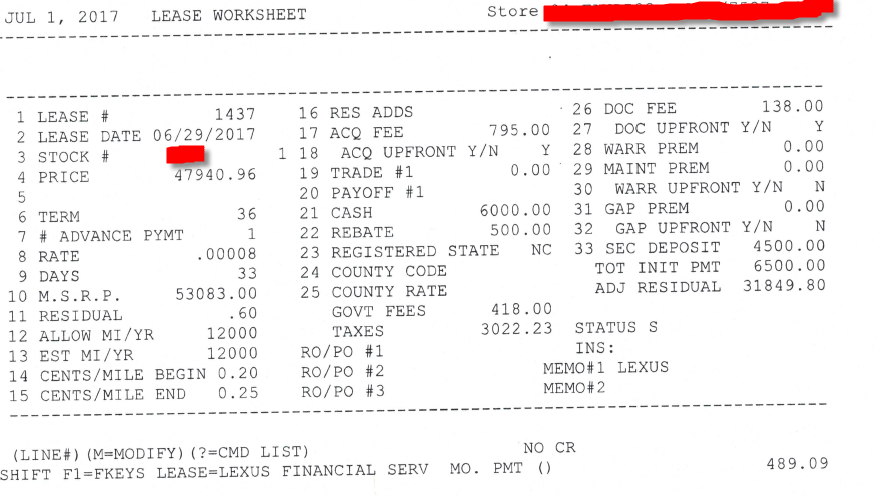

Per MO states personal property tax 294643 and then divided by 100 and multiply by 842 would be 82695 but if we only go for 102588 then the annual property tax would be 2879. The state sales tax for a vehicle purchase in Missouri is 4225. Certificate of Personal Property Non-Assessment if.

To renew the license plates on a leased vehicle one of the following documents will need to be presented to the Department of Revenue. Leased vehicles should NOT be reported on an Individual Personal Property Assessment Form. I lease my vehicle who pays the personal property taxes.

The most common method is to tax monthly lease payments at the local sales tax rate. In California the sales tax is 825 percent. How much is Missouri property tax on cars.

If you are registering a leased motor vehicle or. Missouri as a leasing company under the fictitious name provisions of Sections 417200 to 417230 RSMo. The first step is to visit the Missouri Department of Revenue website and create an.

The study collected data on vehicle property and real-estate property taxes in each state measuring states based on effective tax. The local car tax is 1812 if the price is 18200 x 70.

City Wide Motors Buy Here Pay Here Car Dealership In Kansas City Mo

Used Cars In Missouri For Sale Enterprise Car Sales

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Taxes In The United States Wikipedia

What S The Car Sales Tax In Each State Find The Best Car Price

10640 10650 Business Route 21 Hillsboro Mo 63050 Loopnet

Pros Cons On Leasing Vehicles David Pope Insurance

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Tangible Personal Property State Tangible Personal Property Taxes

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Pros Cons On Leasing Vehicles David Pope Insurance

Taxes And Lease Calculation Ask The Hackrs Forum Leasehackr

Buy A New Car In Utah Southtowne Automall

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

Motor Vehicle Additional Help Resource

Leasing A Car And Moving To Another State What To Know And What To Do